At some point, you have likely heard of APIs or Application Programming Interfaces. It’s quite common for individuals to have heard of this technology but maybe not fully understand what APIs do or why they matter. This is because they are often utilized on the back-end of our software experiences as a consumer. Everyday interactions from tracking a package through a retailer’s website to checking fantasy football scores often use APIs to improve our user experience across any number of industries.

Put simply, an API allows for two different applications to talk to each other. This helps foster collaboration between two or more different technology providers to extend the capabilities of their product or service.

In the financial planning process, APIs provide an exceptional opportunity for organizations, advisors, and their clients.

APIs empower advisors

For advisors, APIs can help ensure that data flowing through a financial planning platform is fully up-to-date and precisely accurate. In NaviPlan, this is made possible through the account aggregation APIs utilized in partnership with MX. This technology enables an advisor’s clients to link their accounts and loans from thousands of financial institutions. Advisors can then be confident they are providing best-interest advice by making recommendations based on real-time information.

APIs expand client opportunities

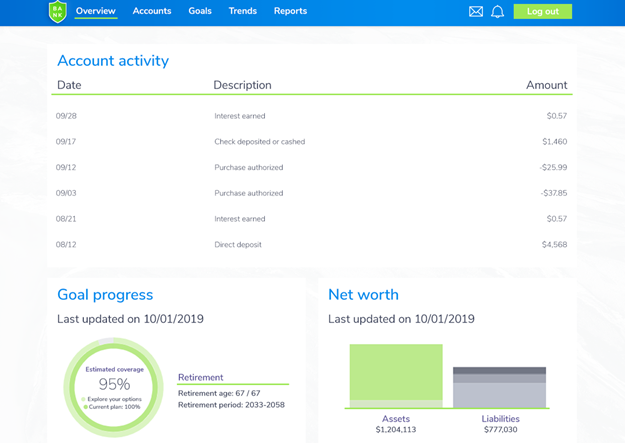

On the client side, APIs help institutions provide a wide range of tools and services to help meet their financial goals. For example, consider the NaviPlan client portal – a tool for clients to check on plan data, adjust contributions, and assess goal progress.

As shown above, this robust tool can be leveraged by financial institutions right within their own online platform. Clients who may find themselves worried about their savings situation or goal progress can instantly discover a path for success from the comfort of their own home. This type of seamless access is what APIs enable.

APIs liberate organizations

Perhaps the most powerful aspect of APIs is how dynamic they can be. Developers at financial institutions or financial technology providers can easily create customized workflows, integrate with other technology providers, or even embed third-party capabilities within their user experiences – things that would have required a significant amount of time and effort to build in house from scratch.

Not only do APIs open the door to offering a better client experience but can also aid in arriving at key business decisions across the organization. For instance, imagine a local credit union decides to integrate client portal functionality within their own client dashboard using APIs. With the new tool in place, advisors notice a surprising number of clients between the ages of 35 and 40 are assessing the impact of altered time horizons on their retirement outlook. The institution can then use this information to determine if it is offering the right services to meet the needs of this segment and if more advisor resources should be dedicated to serving the demand. Had the credit union been unable to build-in the portal functionality due to limited in-house development resources, this type of discovery may never have been made.

Want to learn more on how NaviPlan APIs can help build a better experience for organizations, advisors, and clients? Click here to request a free trial and more information.