There are many different phases when building a financial plan for your client. NaviPlan® financial planning software follows the most common six steps of financial planning:

1. Lead generation

2. Data collection

3. Data analysis

4. Recommendations

5. Action plan

6. Periodic review

Within these six steps, there can be a lot of back and forth when it comes to communication with your client. Let’s take a quick look at what this timeline might look like:

- Monday, August 6th: You send a fact finder on to your client to collect data.

- Thursday, August 9th: They send the completed fact finder back to you.

- Monday, August 13th: You then spend the next couple of days entering this client's data. You analyze this data and confirm for accuracy.

- Wednesday, August 15th: You set up recommendations with three slight adjustments that solve your client's shortfall, or, you set up three separate alternative plans with very different options in each, just to show every scenario imaginable.

- Monday, August 20th: You request a meeting for two weeks after initially requesting your client's data.

- Wednesday, August 22nd: You sit down with your client and show the recommendations you suggest they implement to solve for their retirement goal shortfall.

In all, this process can take weeks if your client is responsive and even longer if they aren’t! NaviPlan’s Presentation Module simplifies and expedites this process saving you time and improving your client’s experience.

NaviPlan’s Presentation Module is a slideshow marketing presentation that can be used to either review or input a clients’ data. One of the many benefits is that these presentations resonate well with clients and can be utilized whether this is an existing client or a brand new client’s first meeting. Let’s take a look at a few screenshots of our Presentation Module to see how we can cut weeks off the planning process.

.png)

This first slide is typical of an informational slide. This slide will have different facts and talking points about retirement. Keep in mind, this slide is designed to speak to your clients as the audience, not you the advisor.

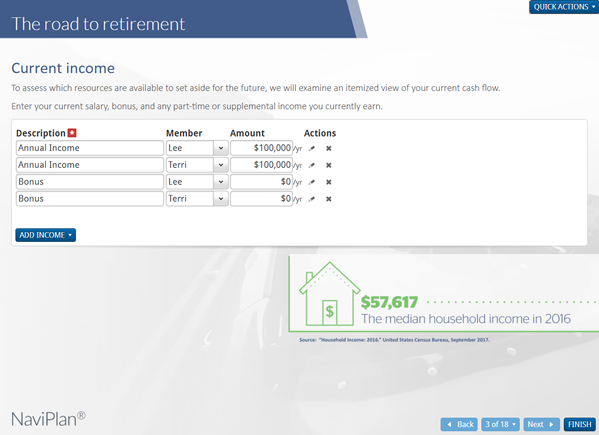

Next, is a data entry slide. Here you will either see an existing client’s previously entered data, or the ability to enter data when working with a brand new client. You’re still able to plan as you normally would but in a more engaging, client facing fashion. This means you can still add, edit, or delete data as you would in the regular planning mode.

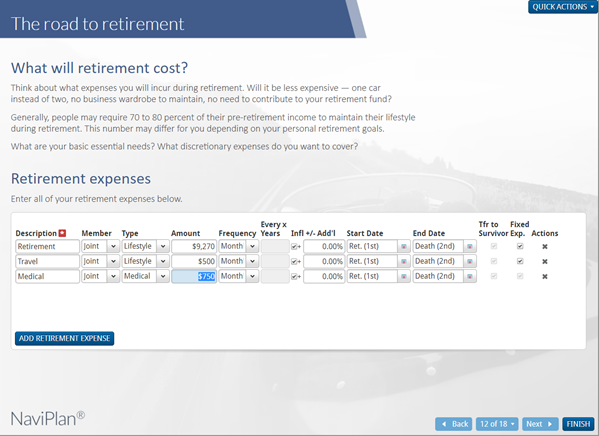

This retirement slide will be a combination of information and data entry. First, there are talking points towards the top of the slide to get the conversation about retirement started. Below that, you will see the retirement expenses as you have entered them. Again, if you want to add, delete or edit information, you can do so here. After you complete all of the data entry from net worth, to cash flow, to goal, you can move into the “How do things look so far?” slide.

This is one of the more powerful slides in our Retirement Presentation. Here you will show your client their current goal coverage and options to achieve 100% goal coverage. For instance, if your client is 75% covered, you can work with them to modify assumptions and strategies to be in a better position. Rather than taking a stab in the dark on your recommendations, you’re able to work directly with your client to get their input on possible solutions for reaching higher goal coverage.

As you wrap up the conversation with your client, you have the ability to print off a short report outlining the information that was reviewed. This gives clients a tangible piece to refer back to, putting your firm back in their mind.

There are many more ways that the features in Presentation Module will benefit your firm, but these are some of the most common. For one, you are going to save an immense amount of time when completing the six steps of financial planning. Creating a financial plan can take weeks, but with Presentation Module, a base plan can be completed in just one meeting. The interactive plan building process helps gain trust and strengthen the client relationship by building a plan with your client, not just for them.

The result of these benefits is a faster-growing firm. Minimizing time spent completing plans allows for a larger client base, while the trust built in the plan building process can lead to more referrals.

To learn more about how utilizing NaviPlan’s Presentation Module can help grow your firm, click here.